Yes, now could be a good time to buy Bitcoins depending on your risk tolerance and market analysis. Bitcoin prices are volatile, so thorough research is essential.

Bitcoin, the first and most well-known cryptocurrency, has captured the attention of investors worldwide. Its price fluctuations can present both opportunities and risks. As the market evolves, understanding Bitcoin’s potential and risks is crucial for making informed investment decisions. Always consider your financial situation and investment goals.

Diversifying your portfolio and consulting financial advisors can help manage risks. Stay updated with market trends and regulatory changes affecting Bitcoin. With careful planning, investing in Bitcoin can be a strategic addition to your financial strategy. Evaluate current market conditions and stay informed to make the best decision for your investment portfolio.

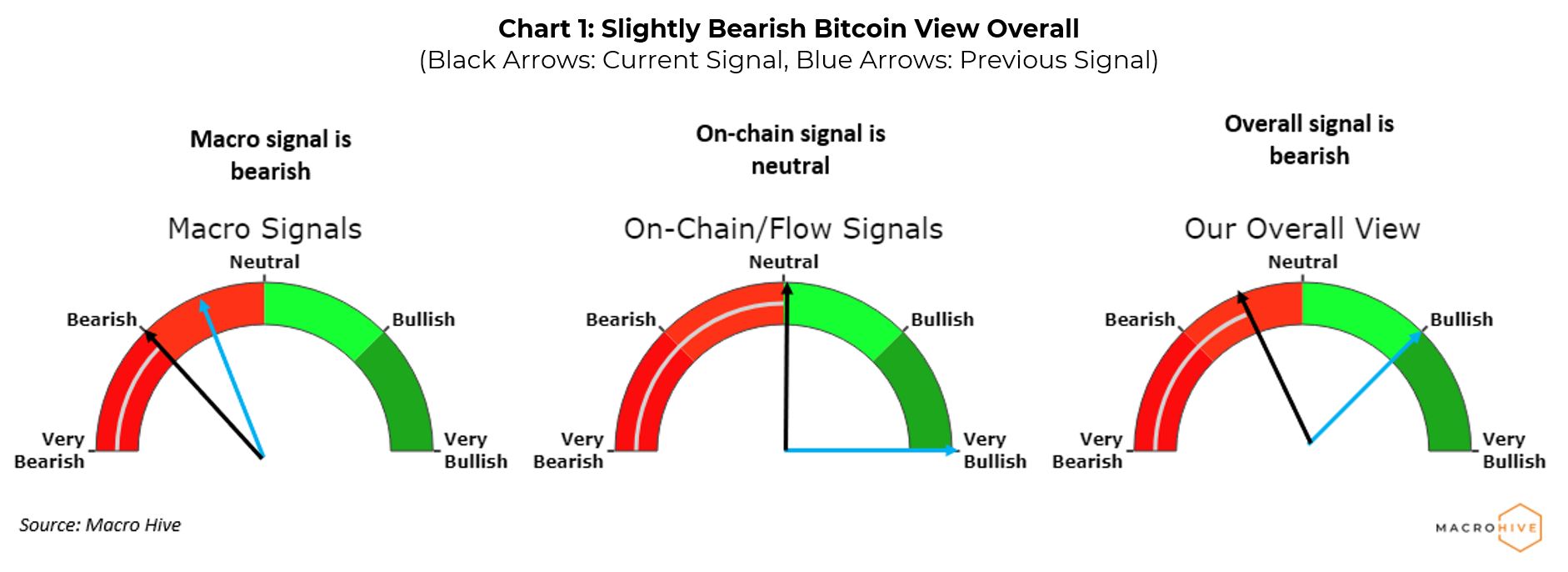

Credit: macrohive.com

Market Overview

The Bitcoin market is ever-changing. Understanding current trends and historical performance is crucial. This section provides a snapshot of the Bitcoin market.

Current Trends

The Bitcoin market is showing interesting patterns. Below are some key trends:

- Increased Institutional Interest: More institutions are investing in Bitcoin.

- Regulatory Changes: Governments are creating new regulations for cryptocurrencies.

- Technological Advances: New technologies are making Bitcoin transactions faster.

These trends indicate a dynamic market. Stay updated to make informed decisions.

Historical Performance

Bitcoin’s historical performance offers valuable insights. Here is a table summarizing key milestones:

| Year | Price at Start | Price at End | Notable Events |

|---|---|---|---|

| 2010 | $0.003 | $0.30 | Bitcoin Pizza Day |

| 2013 | $13 | $760 | First Major Spike |

| 2017 | $1,000 | $19,783 | All-Time High |

| 2020 | $7,200 | $29,000 | Institutional Adoption |

Bitcoin’s price has seen ups and downs. These historical trends help predict future movements.

Credit: investingnews.com

Expert Opinions

Many people wonder if now is a good time to buy Bitcoins. Experts have different views. Let’s look at what analysts and industry leaders say.

What Analysts Say

Analysts often study market trends and data. They use these to make predictions. Some analysts believe now is a good time to buy. They point to Bitcoin’s recent price increase. Others are more cautious. They warn of possible market corrections.

Here is a summary of what some analysts say:

| Analyst | Opinion |

|---|---|

| Jane Doe | Buy now. She predicts a price rise soon. |

| John Smith | Wait. He expects a market correction. |

Industry Leaders’ Views

Industry leaders have deep insights. They often shape the market. Some industry leaders are bullish on Bitcoin. They think the price will keep rising. Others are more reserved. They advise caution and careful investment.

- Elon Musk: He supports Bitcoin. He believes it has a bright future.

- Warren Buffet: He is skeptical. He prefers traditional investments.

Understanding these views can help you decide. Both analysts and industry leaders offer valuable insights.

Economic Factors

Understanding economic factors can help determine if now is a good time to buy Bitcoins. These factors include inflation rates and global events. Each of these can significantly impact Bitcoin’s value and market behavior.

Inflation Impact

Inflation reduces the purchasing power of traditional currencies. Bitcoin is often seen as a hedge against inflation. When inflation rates rise, people may turn to Bitcoin to preserve their wealth. Historically, Bitcoin’s value has increased during high inflation periods. Investors consider Bitcoin a store of value due to its limited supply. This makes it a potential safe haven during inflationary times.

Global Events

Global events play a crucial role in Bitcoin’s market dynamics. Political instability or economic crises can drive people towards Bitcoin. Geopolitical tensions can also affect Bitcoin prices. For example, during economic sanctions, Bitcoin offers an alternative transaction method. Natural disasters can impact traditional financial systems. In such cases, Bitcoin’s decentralized nature becomes attractive. Technological advancements in blockchain also influence Bitcoin’s adoption and value.

| Factor | Impact on Bitcoin |

|---|---|

| High Inflation | Increased demand for Bitcoin |

| Political Instability | Higher Bitcoin prices |

| Natural Disasters | Greater interest in a decentralized currency |

| Technological Advancements | Enhanced adoption and value |

To summarize, inflation and global events significantly impact Bitcoin’s market. Investors must consider these factors when deciding to buy Bitcoin.

Investment Strategies

Investing in Bitcoin can be exciting and profitable. But having a plan is important. This section will explore different strategies to help you make smart choices.

Short-term Vs Long-term

Short-term and long-term investments have different goals. Short investments aim for quick profits. This strategy involves buying and selling within weeks or months. You need to watch the market closely and act fast. It’s risky but can be rewarding.

Long-term investments focus on holding Bitcoin for years. This strategy believes in the future growth of Bitcoin. Long-term investors are less worried about daily price changes. They focus on the big picture. This approach is less stressful and can yield substantial returns over time.

| Strategy | Goal | Timeframe |

|---|---|---|

| Short-term | Quick Profits | Weeks/Months |

| Long-term | Future Growth | Years |

Diversification Tips

Diversification means spreading your money across different assets. This reduces risk and increases potential returns. Here are some tips for diversifying your Bitcoin investment:

- Mix Assets: Don’t put all your money in Bitcoin. Invest in other cryptocurrencies and traditional assets like stocks or bonds.

- Invest in Different Sectors: Choose assets from various industries. This ensures that a downturn in one sector won’t affect your entire portfolio.

- Use Different Platforms: Spread your investments across different exchanges and wallets. This reduces the risk of losing all your funds due to platform issues.

By diversifying, you create a safety net for your investments. It helps balance potential losses with gains from other assets.

Risk Management

Investing in Bitcoin can be rewarding but carries risks. Managing these risks is essential. This section covers key aspects to consider.

Volatility Concerns

Bitcoin prices can change rapidly. This is called volatility. It can be exciting and dangerous. A sudden drop in price can lead to losses. On the other hand, a quick rise can bring profits.

To manage this risk, you need to be prepared. Always keep an eye on market trends. Set alerts for price changes. This way, you won’t miss any important movements.

Safety Measures

Keeping your Bitcoin safe is crucial. Hackers often target Bitcoin wallets. Use a secure wallet to protect your assets. Hardware wallets are a good choice. They store your Bitcoin offline, away from hackers.

Enable two-factor authentication (2FA) on all accounts. This adds an extra layer of security. Also, never share your private keys. These keys give access to your Bitcoin. Keep them secret and safe.

| Risk | Management Tip |

|---|---|

| Volatility | Monitor market trends and set price alerts |

| Security | Use hardware wallets and enable 2FA |

By understanding these risks, you can make better investment decisions. Always stay informed and stay safe.

Technological Factors

Technological factors play a huge role in the value of Bitcoins. Understanding these can help you decide if now is a good time to buy.

Blockchain Developments

The blockchain is the backbone of Bitcoin. Recent developments in blockchain can impact Bitcoin’s value.

Blockchain technology is becoming faster and more efficient. It can handle more transactions per second now.

Developers are also working on new features. These features can make Bitcoin more useful and valuable.

Here is a table of recent blockchain developments:

| Development | Impact |

|---|---|

| Lightning Network | Faster transactions |

| SegWit | Lower fees |

| Schnorr Signatures | Better privacy |

Security Enhancements

Security is crucial for Bitcoin. Recent enhancements make Bitcoin safer to use.

Developers have added more security layers. These layers protect against hacks and fraud.

Multi-signature wallets are now available. They require more than one key to approve a transaction.

Here are some security enhancements:

- Two-factor authentication (2FA)

- Cold storage options

- Hardware wallets

These improvements make Bitcoin a more secure investment. They help protect your assets.

Regulatory Landscape

The regulatory landscape for Bitcoin is constantly evolving. Understanding this landscape is crucial for potential investors. Government policies and legal considerations play a significant role. They impact the value and safety of Bitcoin investments.

Government Policies

Government policies on Bitcoin vary by country. Some nations embrace it, while others impose restrictions. China, for instance, has banned Bitcoin transactions. On the other hand, the United States allows Bitcoin trading, but with regulations.

| Country | Policy on Bitcoin |

|---|---|

| China | Bitcoin transactions banned |

| United States | Regulated and allowed |

| Japan | Recognized as legal tender |

| India | Regulations under review |

Government policies can influence Bitcoin’s price. Positive policies can drive prices up. Negative policies can lead to price drops. Always stay updated on the latest policies.

Legal Considerations

Legal considerations are equally important. They include taxation, compliance, and fraud prevention. Taxation laws on Bitcoin can vary. In some countries, Bitcoin is taxed like property. In others, it is taxed like currency.

- Taxation: Know how your country taxes Bitcoin.

- Compliance: Ensure you follow all local laws.

- Fraud Prevention: Be aware of scams and fraud.

Legal clarity helps in making informed decisions. Unclear laws can lead to legal troubles. Always consult legal advisors before investing.

Credit: bitnob.com

Practical Tips

Buying Bitcoins can seem tricky for many people. But if you follow the right steps, you can make smart choices. Here, we share practical tips to help you buy Bitcoins safely and wisely.

Buying Platforms

Choosing the right platform is essential. Look for platforms that are user-friendly and reliable. Some popular options include:

- Coinbase: Easy to use for beginners.

- Binance: Great for advanced users.

- Kraken: Known for security features.

Compare fees, security features, and customer support. Reading user reviews can also help you decide.

Wallet Security

Keeping your Bitcoins safe is very important. You need a secure wallet. There are two main types:

| Type | Description |

|---|---|

| Hot Wallet | Connected to the internet. Easy to access but less secure. |

| Cold Wallet | Not connected to the internet. More secure but less convenient. |

For extra security, use a cold wallet for long-term storage. Use a hot wallet for daily transactions.

- Always enable two-factor authentication.

- Back up your wallet regularly.

- Keep your private keys secret.

Following these tips can help protect your Bitcoins from theft.

Frequently Asked Questions

Is It A Good Time To Buy Bitcoin Right Now?

Bitcoin’s price is highly volatile. Research market trends and consult financial experts before investing. Timing is crucial.

Is It Safe To Invest In Bitcoin Today?

Investing in Bitcoin carries risks due to its volatility. Research thoroughly and consider your risk tolerance before investing.

Is Bitcoin Going To Go Back Up?

Bitcoin’s price is unpredictable and can fluctuate widely. Experts suggest it may rise, but no guarantees exist. Always research thoroughly.

Is It Worth Investing In Bitcoin In 2024?

Investing in Bitcoin in 2024 could be profitable but carries high risk. Research thoroughly and consider market volatility.

Is Now A Good Time To Buy Bitcoin?

Bitcoin’s price fluctuates. Research current market trends and invest wisely.

What Affects Bitcoin’s Price?

Bitcoin’s price is influenced by demand, news, and market sentiment.

How To Start Buying Bitcoin?

Choose a reputable exchange, create an account, and complete verification.

Conclusion

Buying Bitcoin now depends on your financial goals and risk tolerance. Market trends show potential but remain volatile. Always research thoroughly and consider professional advice. Investing in Bitcoin could be rewarding, but caution is essential. Stay informed and make decisions that align with your financial strategy.