Crypto Market Cap refers to the total value of all cryptocurrencies combined. It is calculated by multiplying the current price of a cryptocurrency by its total supply.

Crypto market cap is a crucial metric in the digital currency world. It helps investors gauge the overall size and health of the market. A higher market cap often indicates a more stable and established cryptocurrency. Bitcoin and Ethereum usually top the list due to their high market caps.

Tracking market cap trends can provide insights into market movements and potential investment opportunities. It is essential for anyone involved in cryptocurrency trading or investing. Understanding market cap can help make informed decisions. Keep an eye on it to stay ahead in the crypto market.

Introduction To Crypto Market Cap

Market cap is short for market capitalization. It is a way to measure the value of a cryptocurrency. To find the market cap, multiply the current price by the total supply of coins. A higher market cap means a more valuable and stable cryptocurrency. People use market cap to compare different cryptocurrencies. It helps investors decide where to put their money.

Market cap is very important in the crypto world. It shows the overall size of a cryptocurrency. A high market cap often means that crypto is trusted by many people. It can also indicate lower risk. A low market cap can mean higher risk but also higher reward. Investors use market cap to judge potential investments. It helps them see which cryptos are growing and which are not.

Credit: www.reuters.com

Calculating Market Cap

The market cap of a cryptocurrency is calculated by multiplying the current price by the total supply. This simple formula helps investors understand the size and value of a crypto asset. For example, if a coin is priced at $10 and there are 1 million coins, the market cap is $10 million.

Several factors can affect the valuation of a cryptocurrency. The supply and demand of a coin play a crucial role. High demand can increase the price, leading to a higher market cap. Technological developments and regulations also impact valuation. Positive news and adoption by mainstream companies can boost investor confidence.

Types Of Market Caps

Large-cap cryptocurrencies have a market cap of over $10 billion. They are often considered safe investments. Bitcoin and Ethereum are examples. These coins have high liquidity. Investors trust them more due to their stability.

Mid-cap cryptocurrencies have a market cap between $1 billion and $10 billion. They carry more risk than large caps. But they also offer higher potential returns. Examples include Chainlink and Stellar. They strike a balance between risk and reward.

Small-cap cryptocurrencies have a market cap under $1 billion. They are highly volatile and risky. These coins can offer huge returns but also massive losses. Examples include Dogecoin and Shiba Inu. Investors need to be cautious with small caps.

Market Cap Vs. Price

Many think a high price means a coin is valuable. This is not always true. Market cap is a better measure. It shows the total value of all coins. A coin with a low price but many coins can have a high market cap. This means the coin is very valuable. Focusing only on price can be misleading.

Market cap is a crucial indicator. It combines the price and the supply of a coin. Another good measure is trading volume. High trading volume means many people are buying and selling the coin. This shows trust and interest. Circulating supply is also important. It tells how many coins are in use. Understanding these indicators helps in making smart investment choices.

Growth Indicators In Crypto

Adoption rates are increasing quickly. More people are using cryptocurrencies every day. Businesses are starting to accept crypto as payment. This helps the market grow. New users add value to the market.

Technological advancements are driving the crypto market. Improved blockchain technology makes transactions faster. Security features are getting better. This makes crypto safer to use. Innovations attract more users and investors.

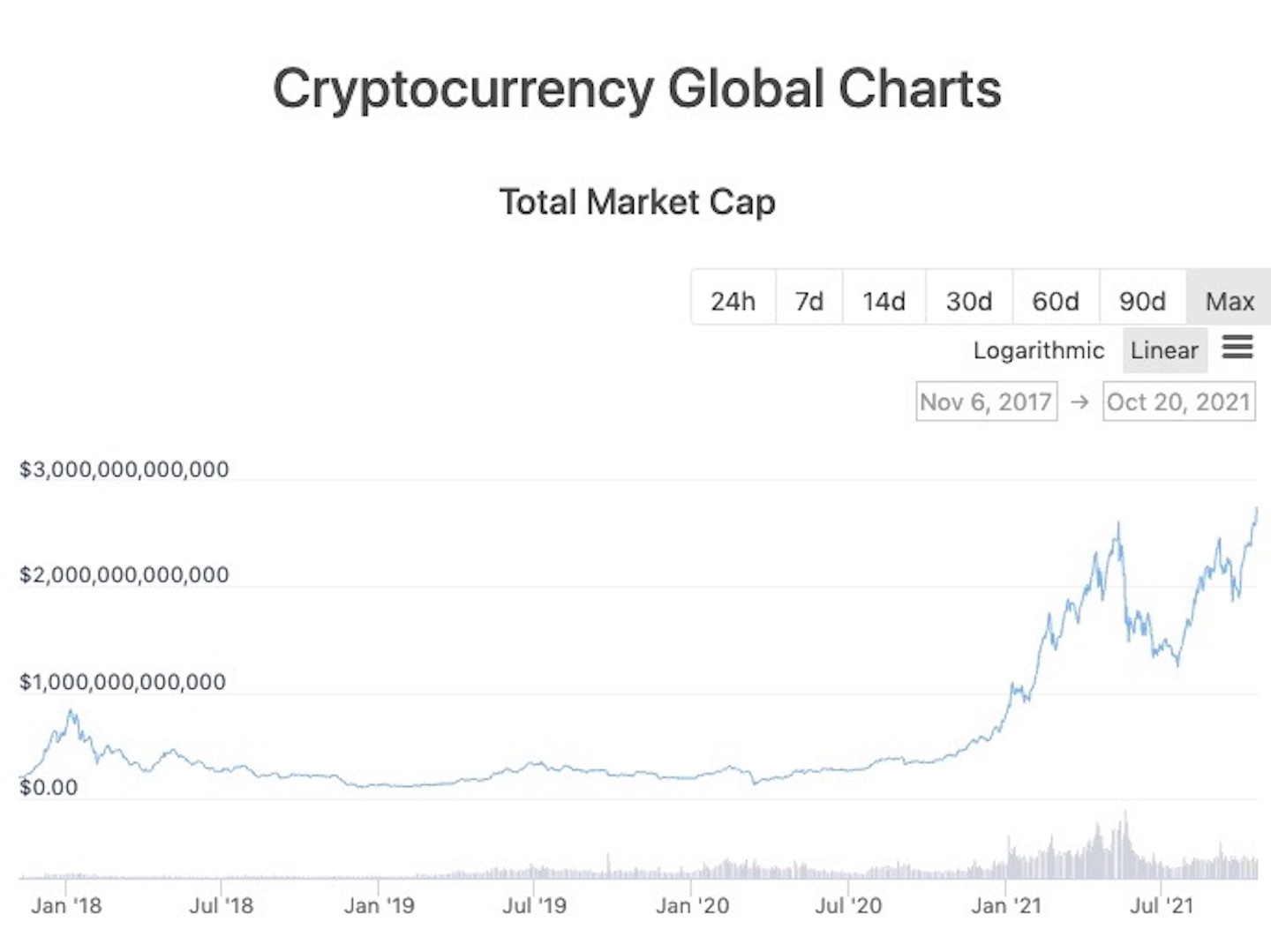

Historical Market Cap Trends

Bitcoin started with a very low market cap. Only a few people knew about it. Its value was just a few cents. Bitcoin gained attention slowly. More people began to invest. The market cap grew steadily over time.

Altcoins began to emerge after Bitcoin. Ethereum, Litecoin, and Ripple are some examples. Each had its unique features. People started to diversify their investments. The overall crypto market cap increased. Altcoins contributed significantly to this growth.

Impact Of Market Cap On Investment

Market cap shows the size of a cryptocurrency. Large market cap coins are less risky. Small market cap coins can be very risky. Knowing the market cap helps in making better investment decisions.

Diversifying your crypto portfolio is smart. Invest in coins with different market caps. This reduces the overall risk. You can have a mix of large, medium, and small-cap coins. This strategy can help balance profits and losses.

Credit: www.coindesk.com

Future Of Crypto Market Cap

The crypto market is growing fast. Experts predict higher market caps. More people are investing in digital currencies. New coins are launched every month. Blockchain technology is improving. This will make transactions faster. DeFi platforms are also on the rise.

Governments are showing interest. They might create their digital currencies. Institutional investors are also joining the market. This could bring in more money. Crypto adoption is spreading worldwide.

Regulation issues may slow growth. Different countries have different laws. This can confuse investors. Market volatility is another problem. Prices can change quickly. This scares some people. Security risks are also a concern. Hackers target crypto exchanges.

Energy consumption is high in mining. This impacts the environment. Scams and frauds are common. People need to be careful. Technological barriers can limit access. Not everyone understands blockchain. These challenges need solutions.

Credit: www.coindesk.com

Frequently Asked Questions

What Is The Market Cap Of Crypto?

The market cap of crypto refers to the total value of all cryptocurrencies combined. It is calculated by multiplying the current price by the total supply.

Which Crypto Will Rise Today?

Predicting which crypto will rise today is challenging. Market trends, news, and investor sentiment influence prices. Research and analysis are crucial.

Which Crypto Will Boom In 2024?

Predicting the exact crypto to boom in 2024 is challenging. Experts suggest Ethereum, Solana, and Cardano might see significant growth. Always research and consult financial advisors before investing.

What Is The Alt Coin Market Cap?

The altcoin market cap refers to the total value of all cryptocurrencies except Bitcoin. It measures the market size.

What Is Crypto Market Cap?

Crypto market cap is the total value of all cryptocurrencies.

How Is Crypto Market Cap Calculated?

It’s calculated by multiplying the coin’s price by its circulating supply.

Conclusion

Understanding the crypto market cap is crucial for any investor. It helps gauge the market’s size and potential. By keeping an eye on the market cap, you can make informed investment decisions. Stay updated and continue learning to navigate the dynamic world of cryptocurrencies.

Happy investing!