A crypto bear market is a prolonged period of declining cryptocurrency prices. Investors experience significant losses during this time.

Crypto bear markets are challenging for investors. Prices drop, leading to panic and uncertainty. These periods test the resilience of both new and seasoned investors. Understanding the causes of a bear market can help navigate its challenges. Market sentiment, regulatory changes, and macroeconomic factors often influence these downturns.

Staying informed and having a long-term strategy is crucial. Diversification can also mitigate risks during a bear market. Patience and careful planning can make a significant difference. By focusing on fundamentals, investors can weather the storm.

Credit: www.binance.com

Introduction To Crypto Bear Markets

Understanding the world of cryptocurrency can be complex. One important concept is the Crypto Bear Market. This phase impacts prices and investor sentiment. Knowing its aspects can help in making better decisions.

Definition And Causes

A Crypto Bear Market is a period where cryptocurrency prices decline. This drop is usually by 20% or more. The market sentiment is negative during this time.

Several factors cause a bear market:

- Regulatory Changes: Governments introduce new rules that impact crypto.

- Market Sentiment: Negative news or events make people sell their assets.

- Economic Factors: Global economic downturns affect investments in crypto.

- Technological Issues: Hacks or technical problems lead to loss of trust.

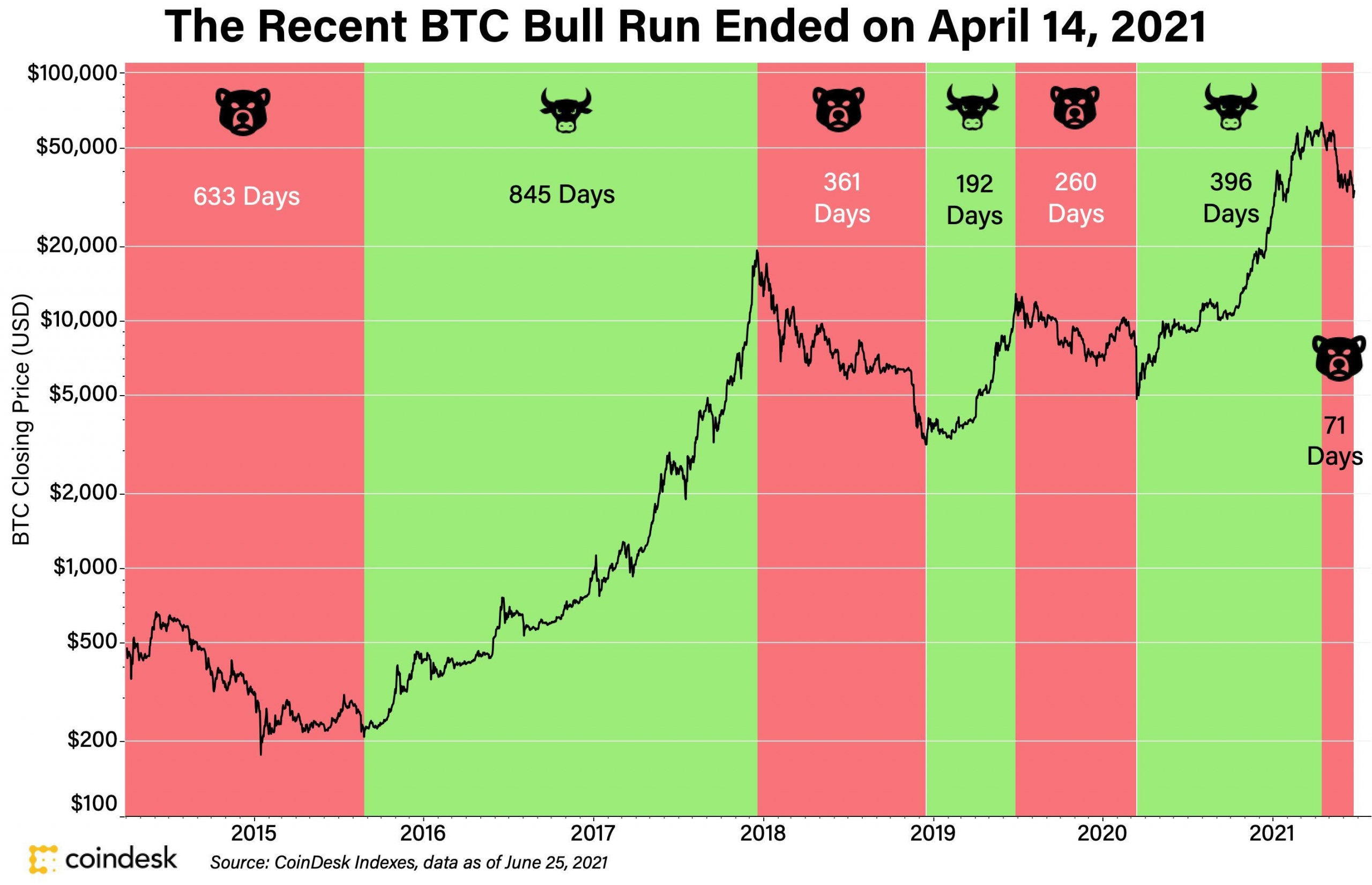

Historical Bear Markets

Crypto has seen several bear markets. Each one has unique triggers and impacts.

Bitcoin’s price dropped from $32 to $2. This was a 94% decline. The cause was a major hack on the Mt. Gox exchange.

Bitcoin fell from nearly $20,000 to $3,200. This was an 84% decrease. The drop was due to regulatory concerns and market corrections.

| Year | Peak Price | Lowest Price | Decline Percentage | Main Causes |

|---|---|---|---|---|

| 2011 | $32 | $2 | 94% | Hack on Mt. Gox |

| 2018 | $20,000 | $3,200 | 84% | Regulatory Concerns, Market Corrections |

Credit: www.coindesk.com

Assessing Your Portfolio

During a crypto bear market, assessing your portfolio is crucial. This involves evaluating risk levels and employing diversification strategies. Both steps can help protect your investments.

Evaluating Risk Levels

First, identify the risk level of each asset in your portfolio. Higher-risk assets can yield higher returns, but they’re more volatile. Lower-risk assets offer stability but lower returns.

- High-Risk Assets: Cryptocurrencies with low market caps.

- Medium-Risk Assets: Established cryptos like Ethereum.

- Low-Risk Assets: Stablecoins like USDC.

Create a table to compare risk levels:

| Asset Type | Risk Level |

|---|---|

| Low Market Cap Cryptos | High |

| Established Cryptos | Medium |

| Stablecoins | Low |

Diversification Strategies

Diversification reduces risk by spreading investments across different assets. This strategy can protect you during market downturns.

- Invest in various cryptocurrencies: Don’t put all your money in one coin.

- Include stablecoins: These coins provide stability during volatile times.

- Allocate funds to different sectors: Invest in DeFi, NFTs, and other blockchain projects.

Follow these diversification strategies for a balanced portfolio. Remember, a diversified portfolio is a safer portfolio.

Staying Informed

During a crypto bear market, staying informed is crucial. Knowledge is power. It can help you make better decisions. Keep up with the latest news. Use reliable tools to analyze the market. This section will guide you on how to stay updated.

Trusted News Sources

Not all news sources are reliable. Stick to well-known platforms. Here are some trusted news sources:

- CoinDesk: A leading news website for crypto.

- CoinTelegraph: Offers daily news and analysis.

- CryptoSlate: Focuses on market trends and industry insights.

These sources provide accurate and timely information. They help you stay ahead of the curve. Avoid websites that spread rumors. Trust only verified news outlets.

Market Analysis Tools

Using the right tools can make a big difference. Here are some top market analysis tools:

| Tool | Features |

|---|---|

| TradingView | Offers charts and technical analysis. |

| CoinMarketCap | Provides market cap and price data. |

| CryptoCompare | Gives detailed crypto comparisons. |

These tools help you track market trends. They offer insights into price movements. Use them to make informed decisions. They can help you navigate a bear market more effectively.

Risk Management Techniques

Navigating a crypto bear market can be challenging. Effective risk management techniques can protect your investments. This section will cover essential strategies to manage your risks.

Setting Stop-loss Orders

Setting stop-loss orders is vital. These orders automatically sell your assets at a specific price. This prevents significant losses during market downturns.

Stop-loss orders help you manage risk without constant monitoring. They act as a safety net for your investments.

| Stop-Loss Order Type | Benefit |

|---|---|

| Fixed Stop-Loss | Easy to set up and understand |

| Trailing Stop-Loss | Adjusts to market movements |

Using Hedging Strategies

Another effective risk management technique is using hedging strategies. Hedging reduces risk by taking an opposite position in a related asset.

Common hedging strategies include:

- Buying put options

- Short selling

- Investing in stablecoins

Hedging helps you balance your portfolio. It provides a cushion against market volatility.

Example of a simple hedging strategy:

1. Hold Bitcoin as your main asset.

2. Buy put options for Bitcoin.

3. If Bitcoin's price drops, the put options gain value.

Long-term Investment Strategies

During a crypto bear market, investors often face uncertainty. Long-term investment strategies can help mitigate risks and seize future opportunities. These strategies focus on patience, research, and consistency. Let’s explore some effective long-term investment approaches.

Identifying Strong Projects

Choosing the right projects is essential. Look for projects with solid fundamentals. Strong teams, clear roadmaps, and active communities are key indicators.

- Solid Teams: Experienced and transparent developers.

- Clear Roadmaps: Achievable and well-defined milestones.

- Active Communities: Engaged and supportive user base.

Research the project’s technology and its real-world applications. Assess the project’s market potential and competition. Strong projects often have unique solutions to existing problems.

Dollar-cost Averaging

Dollar-cost averaging (DCA) is a prudent strategy. It involves investing a fixed amount regularly, regardless of price. This approach reduces the impact of market volatility. Here’s how it works:

| Month | Investment Amount | Price per Coin | Coins Purchased |

|---|---|---|---|

| January | $100 | $10 | 10 |

| February | $100 | $8 | 12.5 |

| March | $100 | $12 | 8.33 |

By spreading investments over time, you buy more coins when prices are low. This strategy can lead to a lower average purchase price over the long term. DCA is particularly useful in volatile markets.

Psychological Resilience

During a Crypto Bear Market, psychological resilience is essential. Investors face emotional and financial challenges. Strengthening mental toughness can help navigate these tough times.

Managing Emotional Stress

Emotional stress can cloud judgment. This leads to poor decisions. Here are some strategies to manage stress:

- Stay informed: Knowledge reduces anxiety.

- Take breaks: Stepping away helps clear the mind.

- Seek support: Talk to fellow investors or professionals.

Additionally, practice mindfulness. This can include meditation or deep breathing exercises. These activities can reduce stress.

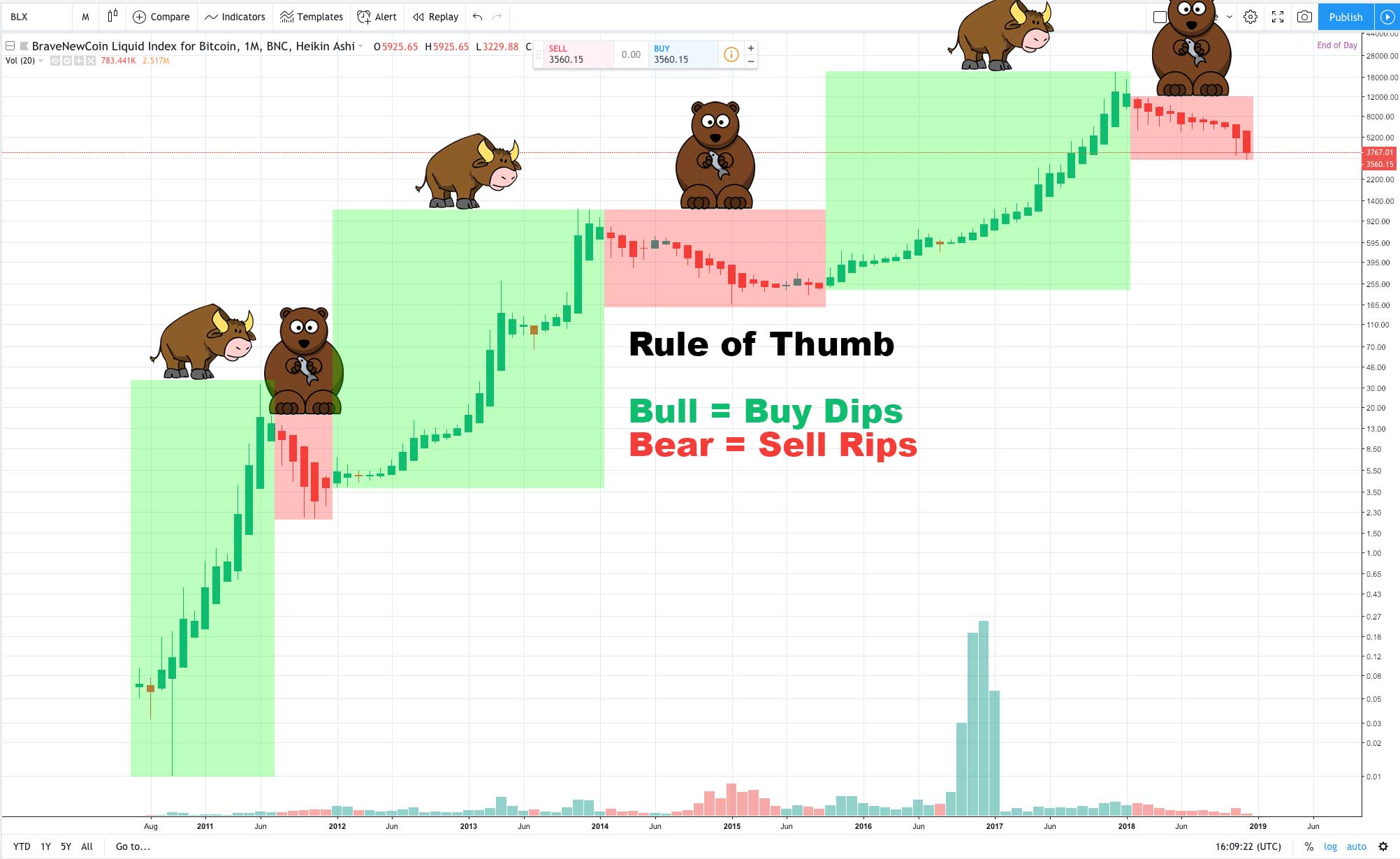

Maintaining A Long-term Perspective

Bear markets are temporary. Keeping a long-term perspective helps maintain confidence. Here are some tips:

- Review past trends: History shows markets recover.

- Set long-term goals: Focus on future gains.

- Avoid panic selling: Selling in fear locks in losses.

Staying calm and focused is crucial. Remember, patience is key to surviving a bear market. Trust the process and your strategy.

Opportunities In A Bear Market

A crypto bear market can be a time of great opportunities. Prices drop, creating chances to buy assets at lower costs. Smart investors can find hidden gems and diversify their portfolios. Let’s explore some of these opportunities.

Finding Undervalued Assets

During a bear market, many assets become undervalued. This is the time to look for quality projects. Strong fundamentals often indicate a good investment. Analyzing the project’s team, technology, and market potential can help.

Use these steps to find undervalued assets:

- Research the project thoroughly.

- Check the team’s background.

- Evaluate the technology.

- Analyze the market demand.

A table can also help compare different assets:

| Asset | Current Price | All-Time High | Market Cap |

|---|---|---|---|

| Bitcoin | $20,000 | $60,000 | $400B |

| Ethereum | $1,500 | $4,000 | $200B |

Exploring Alternative Investments

Bear markets are ideal for exploring alternative investments. Stablecoins provide stability and can earn interest. NFTs offer unique digital ownership opportunities. DeFi platforms allow for decentralized financial services.

Consider these alternatives:

- Stablecoins: Earn interest on your holdings.

- NFTs: Invest in digital art and collectibles.

- DeFi: Use decentralized finance platforms.

Diversifying your investments reduces risk. It ensures a balanced portfolio. This approach can lead to long-term gains.

Credit: cryptocurrencyfacts.com

Learning And Growth

The crypto bear market can be a challenging phase. Yet, it also offers a unique opportunity for learning and growth. During this period, investors can deepen their understanding and build valuable connections. This can position them for future success in the crypto space.

Educational Resources

In a bear market, investors have more time to learn. There are many educational resources available:

- Online Courses: Websites like Coursera and Udemy offer crypto courses.

- Books: Reading books by experts can provide in-depth knowledge.

- Webinars: Many platforms host free webinars on crypto topics.

- Blogs: Following top crypto blogs can keep investors updated.

Utilizing these resources can help investors stay informed and make better decisions.

Networking With Experts

Networking is crucial during a bear market. Connecting with experts can provide valuable insights and support. Here are some ways to network:

- Join Crypto Communities: Platforms like Reddit and Telegram have active crypto groups.

- Attend Conferences: Many events and conferences are held online and offline.

- Follow Influencers: Social media platforms like Twitter host many crypto influencers.

- Participate in Forums: Forums like Bitcointalk are great for discussions and learning.

Building relationships with experts can lead to mentorship and opportunities.

Frequently Asked Questions

What Is Bear Market Of Crypto?

A bear market in crypto refers to a prolonged period of declining prices. Investors often experience pessimism and fear.

Will There Be A Crypto Bull Run In 2024?

Predicting a crypto bull run in 2024 is challenging. Market conditions, regulations, and technological advancements will play crucial roles.

Is Crypto In A Bear Trap?

Crypto could be in a bear trap. It’s crucial to analyze market trends and indicators before making decisions.

What To Expect From Crypto In 2024?

Expect increased regulation, wider adoption, and potential market volatility in crypto for 2024. New technologies may emerge, enhancing security and scalability.

What Is A Crypto Bear Market?

A crypto bear market is when cryptocurrency prices consistently fall.

How Long Do Bear Markets Last?

Bear markets can last from several months to a few years.

What Causes A Crypto Bear Market?

Factors include market sentiment, regulatory news, and macroeconomic conditions.

Conclusion

Navigating a crypto bear market requires patience and strategy. Stay informed, diversify your portfolio, and avoid panic selling. By focusing on long-term goals, you can weather the storm. Remember, market downturns are temporary. Stay calm and make informed decisions to thrive in the future.